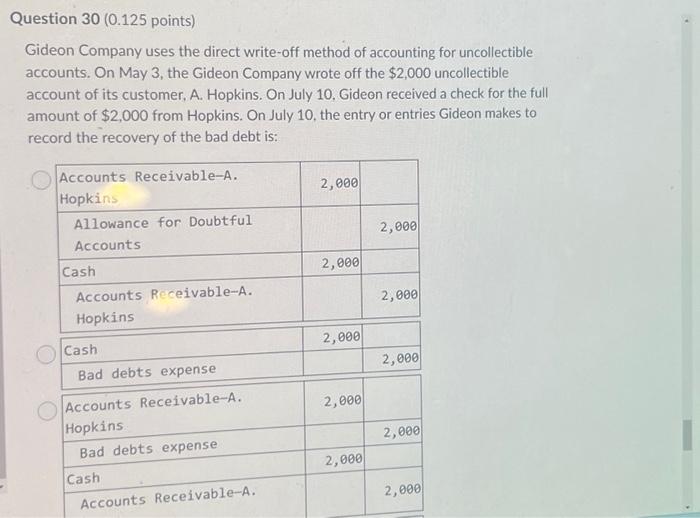

Gideon company uses the direct write-off method – In the realm of accounting, the direct write-off method stands as a valuable tool for managing bad debts. Gideon Company’s adoption of this method has garnered attention, prompting us to explore its intricacies, advantages, and implications. This article delves into the direct write-off method, providing a comprehensive analysis of its practical applications and financial reporting effects.

1. Direct Write-Off Method

The direct write-off method is an accounting technique used to record uncollectible accounts receivable as expenses in the period in which they are deemed uncollectible. This method involves directly reducing the accounts receivable balance and recognizing the corresponding expense.

Advantages of the Direct Write-Off Method

- Simplicity: The direct write-off method is easy to understand and implement, making it suitable for small businesses with limited accounting resources.

- Conservatism: By recognizing bad debts only when they occur, the direct write-off method provides a conservative estimate of financial performance.

Disadvantages of the Direct Write-Off Method, Gideon company uses the direct write-off method

- Inaccuracy: The direct write-off method may not accurately reflect the true level of bad debts, as it only recognizes them when they are deemed uncollectible.

- Potential for Abuse: The direct write-off method can be abused by companies to manipulate their financial statements by intentionally delaying the write-off of bad debts.

When to Use the Direct Write-Off Method

The direct write-off method is appropriate when:

- The amount of bad debts is immaterial to the financial statements.

- The company has difficulty estimating the amount of uncollectible accounts receivable.

- The company has a strong cash flow and can afford to absorb the loss from bad debts.

2. Comparison with Other Methods

Other methods of accounting for bad debts include the allowance method and the percentage of sales method.

Allowance Method

The allowance method involves creating an allowance for doubtful accounts, which is an estimate of the amount of uncollectible accounts receivable. The allowance is adjusted periodically based on estimates of the expected bad debts.

Percentage of Sales Method

The percentage of sales method involves estimating the amount of bad debts as a percentage of sales. This method is often used by companies that have a consistent history of bad debts.

Situations Where Each Method is Most Appropriate

- Direct Write-Off Method:Suitable for small businesses with immaterial bad debts or difficulty estimating uncollectible accounts.

- Allowance Method:Appropriate for companies with a significant amount of bad debts and the ability to estimate uncollectible accounts accurately.

- Percentage of Sales Method:Suitable for companies with a consistent history of bad debts and a stable sales volume.

Implications of Using Different Methods for Financial Reporting

The choice of accounting method for bad debts can impact financial reporting by:

- Affecting the net income and net loss reported.

- Influencing the balance sheet by reducing accounts receivable and increasing the allowance for doubtful accounts.

- Impacting key financial ratios, such as the accounts receivable turnover ratio and the gross profit margin.

3. Financial Reporting Implications

The direct write-off method affects financial statements as follows:

Impact on Financial Statements

- Balance Sheet:Reduces accounts receivable and increases the expense account for bad debts.

- Income Statement:Recognizes the expense for bad debts in the period in which the accounts receivable is deemed uncollectible.

Impact on Key Financial Ratios

- Accounts Receivable Turnover Ratio:May decrease due to the reduction in accounts receivable.

- Gross Profit Margin:May decrease due to the recognition of bad debt expense.

Examples of Distortion of Financial Results

The direct write-off method can distort financial results by:

- Understating the amount of bad debts, resulting in an overstated net income.

- Overstating the amount of bad debts, resulting in an understated net income.

4. Impact on Tax Reporting

The direct write-off method affects taxable income by:

Tax Implications

- Deductibility:Bad debts written off using the direct write-off method are deductible for tax purposes in the year in which they are deemed uncollectible.

- Timing:The timing of the tax deduction may differ from the timing of the recognition of the expense for financial reporting purposes.

Examples of Tax Minimization

The direct write-off method can be used to minimize taxes by:

- Accelerating the recognition of bad debts to increase the tax deduction in the current year.

- Delaying the recognition of bad debts to defer the tax deduction to a later year.

5. Practical Considerations: Gideon Company Uses The Direct Write-off Method

The practical considerations of using the direct write-off method include:

Challenges

- Estimating Uncollectible Accounts:Determining which accounts receivable are uncollectible can be challenging and subjective.

- Potential for Abuse:The direct write-off method can be abused by companies to manipulate financial statements.

Opportunities

- Simplicity:The direct write-off method is easy to implement and requires minimal accounting resources.

- Flexibility:The direct write-off method provides flexibility in the timing of the recognition of bad debts.

Recommendations for Effective Implementation

- Establish Clear Criteria:Develop objective criteria for determining which accounts receivable are uncollectible.

- Review Accounts Regularly:Regularly review accounts receivable to identify potential bad debts.

- Seek Professional Advice:Consult with a tax advisor or accountant for guidance on the tax implications of the direct write-off method.

General Inquiries

What is the direct write-off method?

The direct write-off method is an accounting technique that recognizes bad debts as expenses only when they become uncollectible. This method involves directly reducing the accounts receivable balance when a specific debt is deemed uncollectible.

What are the advantages of using the direct write-off method?

The direct write-off method is simple to apply and does not require the creation of an allowance for doubtful accounts. It also avoids the need for complex calculations and estimations, making it a cost-effective option for small businesses.

What are the disadvantages of using the direct write-off method?

The direct write-off method can result in fluctuations in net income, particularly when large bad debts are written off in a single period. It may also lead to an understatement of bad debt expense in the financial statements.