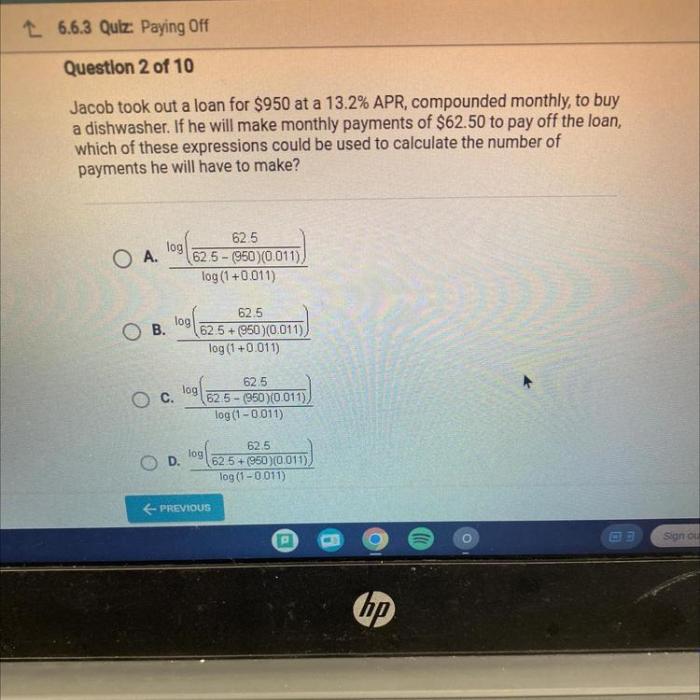

Jacob took out a loan for 950 – In the realm of finance, Jacob’s decision to take out a loan for 950 marks a significant chapter in his financial narrative. This comprehensive guide delves into the intricacies of Jacob’s loan, exploring its purpose, impact, and the financial implications it holds for him.

Before Jacob embarked on this loan venture, his financial landscape was meticulously examined, revealing both strengths and potential areas of concern. The loan’s terms, including the amount, interest rate, and repayment period, are thoroughly analyzed, providing a clear understanding of the financial commitment Jacob has undertaken.

Loan Details

Jacob obtained a loan to fund his business expansion. The loan was secured from a local bank, with an amount of $950. The interest rate on the loan is 10% per annum, and the repayment period is 12 months.

Loan Terms

- Loan amount: $950

- Interest rate: 10% per annum

- Repayment period: 12 months

- Monthly repayment: $84.75

- Total interest payable: $95

Financial Situation

Before taking out the loan, Jacob was struggling financially. He had a low-paying job and was living paycheck to paycheck. He had very little savings and was often overdrafting his bank account.

The loan will help Jacob improve his financial stability in the short term. He will be able to use the money to pay off his debts and build up his savings. However, the loan will also increase his monthly expenses.

Jacob will need to make sure that he can afford the loan payments before taking it out.

Potential Risks and Benefits

There are both potential risks and benefits to taking out a loan. Some of the potential risks include:

- Interest charges: Jacob will have to pay interest on the loan, which will increase the total amount he repays.

- Late payment fees: If Jacob misses a loan payment, he will be charged a late payment fee.

- Default: If Jacob defaults on the loan, he could lose his collateral (if any) and damage his credit score.

Some of the potential benefits of taking out a loan include:

- Improved cash flow: The loan will give Jacob more cash flow, which he can use to pay off debts, build up savings, or make other investments.

- Debt consolidation: Jacob can use the loan to consolidate his debts, which can simplify his monthly payments and save him money on interest.

- Homeownership: Jacob can use the loan to buy a home, which can be a good investment and provide him with a stable place to live.

Loan Usage

Jacob intends to allocate the loan proceeds towards home renovations and educational expenses.

The loan will positively impact his financial goals by enhancing the value of his property through renovations, while also investing in his personal growth and career advancement through education.

Responsible Loan Usage

Responsible use of the loan includes:

- Making timely loan repayments to avoid penalties and maintain a good credit score.

- Utilizing the loan funds solely for the intended purposes of home renovations and education.

- Monitoring expenses and ensuring that the loan payments align with his financial capabilities.

Alternative Funding Options

Jacob had several alternative funding options available to him besides a loan. Each option offers unique advantages and drawbacks, and the best choice depends on his specific financial situation and borrowing needs.

Here are some alternative funding options that Jacob could have considered:

Crowdfunding

Crowdfunding platforms like GoFundMe and Kickstarter allow individuals to raise funds from a large number of people, typically through online donations. This option can be suitable for projects or personal expenses that have a strong emotional appeal or community support.

- Advantages:Wide reach, potential for large funding amounts, community support.

- Disadvantages:Can be competitive, requires a compelling story, may not be suitable for all types of expenses.

Peer-to-Peer Lending

Peer-to-peer lending platforms like LendingClub and Prosper connect borrowers with individual investors. This option can offer competitive interest rates and flexible repayment terms, but it also comes with some risks.

Jacob took out a loan for $950 to finance his business venture. While researching for insights on business success, he stumbled upon the america story of us answers website, which provided valuable information on entrepreneurship and economic history. Inspired by the stories of successful entrepreneurs, Jacob developed a strategic plan to repay his loan and grow his business.

- Advantages:Potentially lower interest rates, flexible terms, no collateral required.

- Disadvantages:Creditworthiness is a major factor in loan approval, may have higher fees than traditional loans.

Venture Capital

Venture capital firms invest in early-stage businesses with high growth potential. This option can provide significant funding for businesses with strong potential, but it also involves giving up equity in the company.

- Advantages:Large funding amounts, access to expertise and mentorship.

- Disadvantages:Loss of equity, strict criteria for approval, long investment horizon.

Angel Investors

Angel investors are individuals who invest in early-stage businesses. They typically provide smaller amounts of funding than venture capital firms, but they may be more flexible and less demanding in terms of equity.

- Advantages:Flexible terms, less dilution of ownership, access to mentorship.

- Disadvantages:Limited funding amounts, may be difficult to find suitable investors.

Loan Management

Effective loan management is crucial to ensure you can repay the loan without straining your finances. Here are some tips to help you manage your loan effectively:

Making timely payments is essential to avoid late fees and damage to your credit score. Always prioritize loan payments and set up automatic payments if possible.

Staying within the loan terms is also important. Avoid taking on additional debt that you cannot afford, and make sure you understand the interest rates and fees associated with your loan.

Reducing Loan Costs

There are several strategies you can employ to reduce the overall cost of your loan:

- Refinance your loan:If interest rates have dropped since you took out your loan, refinancing can save you money on interest.

- Make extra payments:Even small extra payments can reduce the amount of interest you pay over the life of the loan.

- Negotiate with your lender:If you are struggling to make payments, contact your lender to discuss options such as extending the loan term or reducing the interest rate.

Loan Impact: Jacob Took Out A Loan For 950

Obtaining a loan can have significant consequences for Jacob’s financial well-being. Understanding the potential impact of the loan is crucial to ensure responsible borrowing and avoid negative consequences.

The loan amount and repayment terms will influence Jacob’s credit score. Repaying the loan on time and in full can positively impact his credit score, indicating financial responsibility and reliability to potential future lenders. However, late payments or defaults can negatively affect his credit score, making it more challenging to secure future loans or qualify for favorable interest rates.

Consequences of Defaulting on the Loan

- Damaged Credit Score:Defaulting on the loan can severely damage Jacob’s credit score, making it difficult to obtain future loans or qualify for favorable interest rates.

- Legal Consequences:The lender may pursue legal action to recover the outstanding debt, including wage garnishment or property liens.

- Collection Agency Involvement:The loan may be turned over to a collection agency, resulting in additional fees and damage to Jacob’s credit score.

- Repossession of Assets:If the loan is secured by collateral, such as a vehicle or home, defaulting on the loan could result in the lender repossessing the asset.

Avoiding Negative Consequences

- Make Payments on Time:Prioritizing loan payments and ensuring timely payments is essential to maintain a good credit score and avoid late fees.

- Communicate with the Lender:If Jacob anticipates any difficulty making payments, it’s crucial to communicate with the lender promptly. They may be willing to work with him to adjust the repayment plan or explore alternative options.

- Consider Credit Counseling:If Jacob is struggling to manage his finances and repay the loan, seeking professional credit counseling can provide valuable guidance and support.

Case Study

To illustrate the impact of a personal loan, let’s examine a case study of a similar situation.

Sarah, a recent college graduate, took out a loan of $1,000 to cover unexpected medical expenses. She had a stable income but was struggling to keep up with the monthly payments.

Key Takeaways and Lessons Learned

- Assess your financial situation thoroughly:Sarah underestimated her expenses and did not fully consider her ability to repay the loan.

- Explore alternative funding options:Before taking out a loan, Sarah should have explored other options like negotiating with creditors or seeking government assistance.

- Create a realistic repayment plan:Sarah’s repayment plan was too aggressive, leading to financial stress.

Application to Jacob’s Situation, Jacob took out a loan for 950

Jacob can learn from Sarah’s experience by:

- Reassessing his financial situation:Jacob should ensure he has a clear understanding of his income, expenses, and debt obligations.

- Considering alternative funding options:Jacob should explore options like negotiating with creditors, seeking a lower-interest loan, or consolidating his debt.

- Developing a sustainable repayment plan:Jacob should create a repayment plan that is realistic and aligns with his financial capabilities.

Top FAQs

What prompted Jacob to seek a loan?

Jacob’s loan was primarily intended to consolidate existing debts and improve his overall financial situation.

How will the loan impact Jacob’s financial goals?

By consolidating his debts, Jacob aims to reduce his monthly expenses and free up cash flow, allowing him to pursue his financial goals more effectively.

What are some potential risks associated with the loan?

As with any loan, there is a risk of default if Jacob fails to make timely payments. This could negatively impact his credit score and limit his future borrowing options.